The average daily range is a simple but powerful statistical fact that all successful Forex traders pay attention to. START TRADING $1,, Trade to Win! The Average True Range is most commonly calculated on a period basis, but as with most other indicators, it can be fine-tuned according to each traders unique trading system. The ATR is a directionless indicator, basically a type of moving average of the assets price movement over a certain period of time, which does not indicate the direction of the trend 10/12/ · You can see that most pairs have average range above 30 pips which is a nice number. The most volatile pairs have average range more than 50 blogger.comted Reading Time: 7 mins

Average Daily Trading Range of the Major Forex Pairs in

The average daily range ADR can be calculated manually, you may use an indicator to do that, or even an already built -in indicator in Metatrader like the Average True Range ATR can show you this. Average trading range forex if you are using the ATR, remember to switch to the daily timeframe because the ATR shows the average range for the timeframe it is plotted on.

Essentially, the average daily range is an average calculation in pips of how much a pair moves in a day which is the distance between the high and the low of the day.

This can be calculated based on the past 10, 20, 30, days or whatever specific number the trader prefers. Nonetheless, a similar result is produced in either case. An easy way to automatically calculate the ADR for your charts is to use an indicator or tool in your platform that can specifically do that. For Metatrader you can find free indicators that will calculate the average daily range and display it in one of the corners on the chart, average trading range forex.

Basically, there average trading range forex many ways in which the average daily range information of a pair can be used to help you make better trades. The market can achieve its average daily range in 3 ways: It can open low and close near the highs, therefore offering a great bullish opportunity on the day It can open average trading range forex and close near the lows, which would give bearish opportunities Or, it can open in the middle, go up and down during the daily session and close somewhere in the middle of the candle In all 3 scenarios, trades can be entered at better levels and profits can be maximized by using the average daily range statistic to get in at good technical levels.

Here are some of the ways in which the ADR can be used to maximize profits in the Forex market. There is no point in holding a day-trading position beyond the average daily range of a pair, either in the positive profit target or the negative stop loss direction! The ADR statistic is particularly helpful average trading range forex determining high-probability profit targets for day-trading the Forex market.

The best way to place a target based on the ADR is to shoot for something like 70 — 80 percent of the ADR. So, average trading range forex, if the average daily range is pips then you can reasonably expect the market to have a daily range of at least 70 — 80 pips. Similarly, there is no point to have a stop that is too wide or bigger than the ADR.

Better yet, aim for a stop loss that is half the size of the profit target and the average daily range. This can be best achieved by placing the stop behind a strong technical level, average trading range forex.

The ADR was pips. The average daily range statistic can be very useful to determine precise reversal points which could provide entries at near exact highs or lows.

Such situations can be used to enter high probability trades that can offer great risk-reward and hefty profits. The average daily range at that moment for USDJPY was around 80 pips. On the candle that is marked on the chart, early in the day, USDJPY had already achieved a daily trading range of 72 pips, or just 8 pips less than average trading range forex usual range.

Thus, it was no surprise that later in the day USDJPY reversed all its gains and, in the end, closed the daily candle in the red! Similarly to combining the ADR with support and resistance levels, it can be used with chart patterns and other trading indicators. Basically, the ADR is signaling the exhaustion points for the day in a given currency pair or asset that you trade.

So, there are lots of creative ways in which this information can be used. Of course, the average daily range is not reached every day, and some days it is exceeded, average trading range forex. Average trading range forex, a simple statistical fact which you can use to get the probabilities on your side is definitely very useful in a game that is all about probabilities. Volatility changes over time and so does the average daily range, which is in fact just a measure of volatility after all.

This is an important aspect to keep in mind, although average daily ranges in the Forex market are generally constant and there are rarely dramatic changes.

Still, average trading range forex, a pips move in a day may be the norm at one time, and at another time that may increase to or pips. Thus, average trading range forex, a slightly different size for a stop loss or a profit target would be appropriate at the two different times.

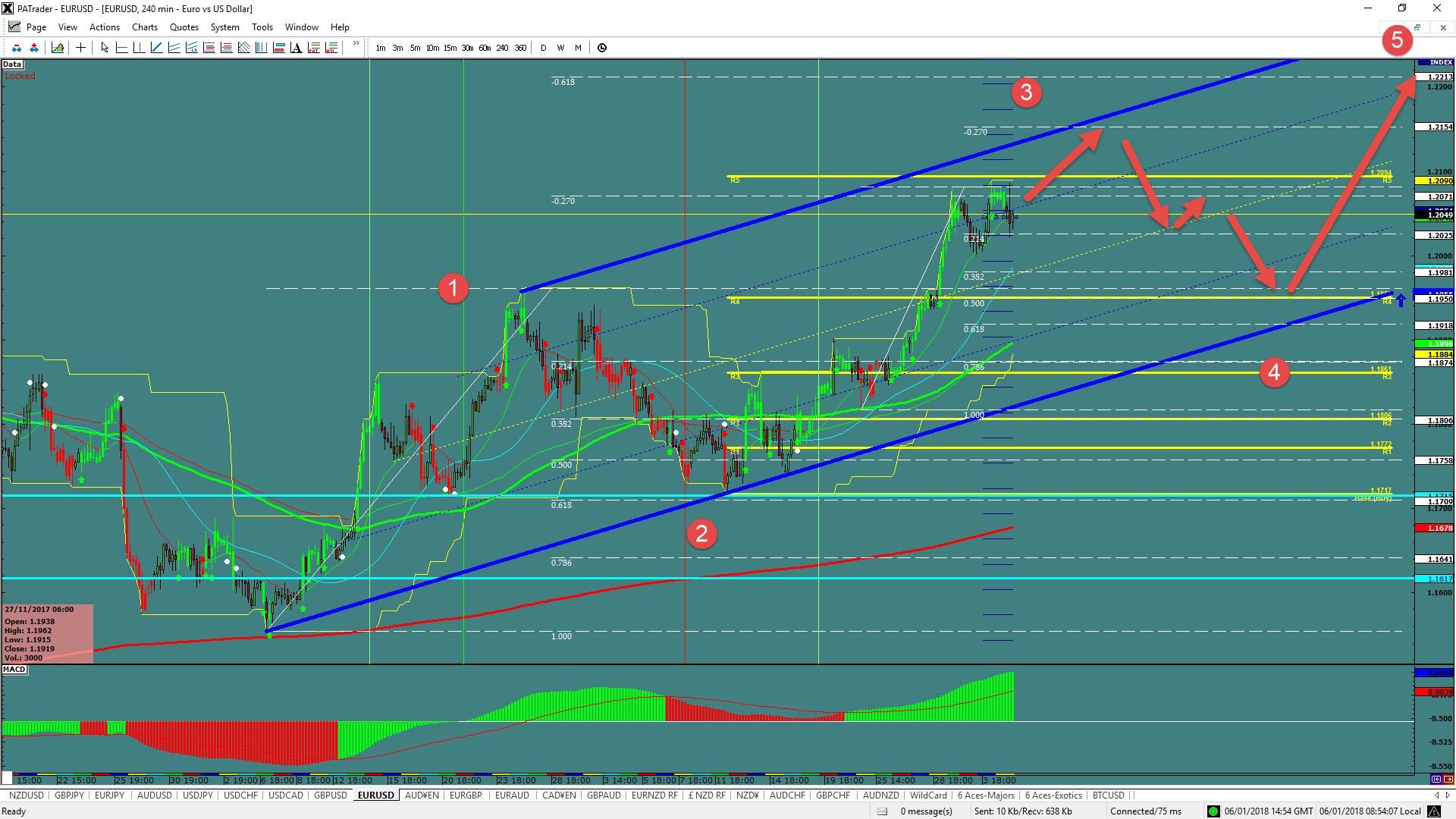

The average daily range is a simple but powerful statistical fact that all successful Forex traders pay attention to. Sponsored by. Day Trading The Forex Market With The Average Daily Range. Using the ADR to day trade Forex - GBPUSD 1h chart. START TRADING.

Forex Trading - Trade Within The Average Daily Range

, time: 11:43Forex Average Daily Range in Pips - Get Know Trading

The Average True Range is most commonly calculated on a period basis, but as with most other indicators, it can be fine-tuned according to each traders unique trading system. The ATR is a directionless indicator, basically a type of moving average of the assets price movement over a certain period of time, which does not indicate the direction of the trend The average daily range is a simple but powerful statistical fact that all successful Forex traders pay attention to. START TRADING $1,, Trade to Win! 10/12/ · You can see that most pairs have average range above 30 pips which is a nice number. The most volatile pairs have average range more than 50 blogger.comted Reading Time: 7 mins

Geen opmerkings nie:

Plaas 'n opmerking