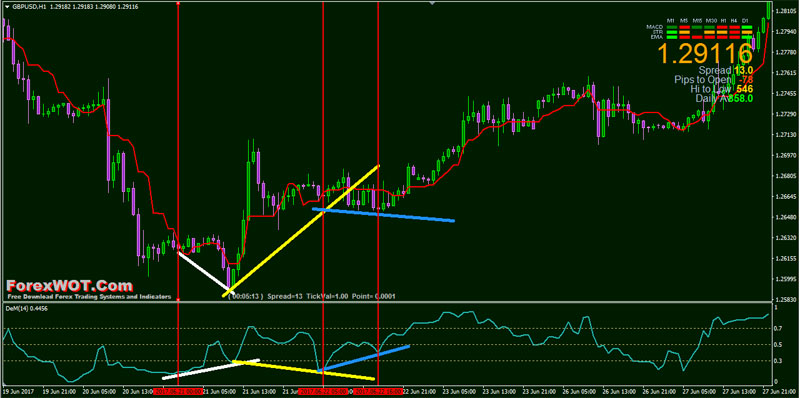

15/03/ · What is Convergence and Divergence? During an upward trend, when desire or tendency for more Buy orders is decreasing and market has been saturated from Buy orders, despite of probable further upward movement, a reversal point is going to appear. This is called blogger.comted Reading Time: 2 mins 06/12/ · Divergences and convergences are a true ally of every trader using technical analysis on the Forex market. These are simple anticipatory signals that allow you to plan in advance for a trend reversal and to filter out a false signal. In this post, we will take a closer look At anything relevant to the subject of convergence and blogger.comted Reading Time: 3 mins What is convergence and divergence in forex? Key Takeaways. Convergence is when the price of an asset and an indicator move toward each other. Divergence is when the price of an asset and an indicator move away from each other. Technical traders are more interested in divergence as a signal to trade. Which time frame is best for MACD?

Divergence and convergence in forex

Take a look at the similar writing assignments. Key Takeaways. Convergence is convergence and divergence forex the price of an asset and an indicator move toward each other. Divergence is when the price of an asset and an indicator move away from each other.

Technical traders are more interested in divergence as a signal to trade. The MACD Triple strategy bases itself on the moving average convergence divergence indicator MACD - 12,26,9, convergence and divergence forex.

The MACD is analyzed in three time frames: 4 hours, 1 hour and 15 minutes. Notice that the ratio of each time frame to the next is The 1-hour and 4-hour MACDs serve as trend filters. Moving average convergence convergence and divergence forex MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Traders may buy the security when the MACD crosses above its signal line and sell—or short—the security when the MACD crosses below the signal line.

How to Use the MACD IndicatorThe first is the number of periods that are used to calculate the faster-moving average. The second is the number of periods that are used in the slower moving average. And the third is the number of bars that are used to calculate the moving average of the difference between the faster and slower moving averages. When the EMA-9 crosses above the MACD 12,26this is considered a bearish signal.

When the MACD 12,26 crosses above the EMA-9, this is considered a bullish signal, convergence and divergence forex. Which technical analysis is best for intraday?

Moving Average Line, convergence and divergence forex. Moving Average Convergence Divergence MACD Relative Strength Index RSI On-Balance-Volume OBV Bollinger Bands. Supertrend Indicator.

Advanced-Decline Line. Still, personally, convergence and divergence forex, I feel that RSI or the relative strength index which is an oscillating momentum indicator ,is the most accurate technical indicator, not only based on its performance but also based on the user-friendly nature. RSI uses numbers to indicate the market conditions. Academics largely see technical analysis as pseudoscientific nonsense. Let's look at the top 10 Forex indicators that every forex traders should know, convergence and divergence forex.

Moving Averages. The concept of convergence and divergence forex average is very important that every trader should know. Relative Strength Index. Bollinger Bands. Ichimoku Kinko Hyo. Average True Range. Meer items In order to forecast future movements in exchange rates using past market data, traders need to look for patterns and signals.

Previous price movements cause patterns to emerge, which technical analysts try to identify and, if correct, should signal where the exchange rate is headed next.

Selecting The Best Indicators For Active Forex TradingOscillator. An oscillator is an indicator that gravitates between two levels on a price chart. Support And Resistance. Relative Strength Index RSI Moving Average Convergence Divergence MACD Commodity Channel Index CCI Parabolic SAR.

Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult. Since most currency pairs are quoted to a maximum of four decimal places, the smallest change for these pairs is 1 pip.

We can do this for any trade size. The calculation is simply the trade size times 0. In 'The Five Orange Pips,' pips, or orange seeds, were sent to various members of the Openshaw family from foreign locations just before their deaths. Through an encyclopedia, Sherlock Holmes connects the sending of orange pips to the KKK. This is a common practice to warn their enemies to comply with orders or die. Main page Questions categories Common psichology Questions to experts Popular subjects Psichology facts Psychology today FAQ convergence and divergence forex psychology Psychology theory Vegetables 1.

Take a look at the similar writing assignments Essay What is convergence and divergence in forex? Get a writing assignment done or a free consulting with qualified academic writer, convergence and divergence forex. Read also What is divergence of a vector function? What is the meaning divergence?

What does the divergence theorem mean? What is a divergence meter? What is the divergence of a vector? What is diverging circuit? What is divergence geology? What is divergence gradient and curl?

What is divergence hypothesis? What is divergence in electromagnetic theory? You will be interested What does Div mean in physics? How do you know if curl is positive or negative? What are the three coordinates of spherical coordinate system?

What is the best indicator to show divergence? What is a negative divergence? What is bullish divergence on MACD? What is div and curl? How is divergence measured? What do you mean by laser divergence? What does divergence theorem mean?

How to use convergences and divergences for trading

, time: 5:38Convergence and Divergence - Forex Reversal Trading Signals

What is convergence and divergence in forex? Key Takeaways. Convergence is when the price of an asset and an indicator move toward each other. Divergence is when the price of an asset and an indicator move away from each other. Technical traders are more interested in divergence as a signal to trade. Which time frame is best for MACD? 15/03/ · What is Convergence and Divergence? During an upward trend, when desire or tendency for more Buy orders is decreasing and market has been saturated from Buy orders, despite of probable further upward movement, a reversal point is going to appear. This is called blogger.comted Reading Time: 2 mins 06/12/ · Divergences and convergences are a true ally of every trader using technical analysis on the Forex market. These are simple anticipatory signals that allow you to plan in advance for a trend reversal and to filter out a false signal. In this post, we will take a closer look At anything relevant to the subject of convergence and blogger.comted Reading Time: 3 mins

Geen opmerkings nie:

Plaas 'n opmerking