rows · First day: The Euro Dollar marks a low point at and a high point at Second Range of Trading Markets. Access 4,+ trading products with competitive pricing and quality execution. Trade 80+ currency pairs, thousands of stocks, popular commodities, indices and cryptocurrencies. Access top companies like Facebook, Amazon and Microsoft with commissions from cents on US stocks. Earn cash rebates when you qualify for the 29 rows · 03/09/ · The maximum daily average range for EUR/CHF gets back to with 96 pips that brought it the Estimated Reading Time: 10 mins

Average Daily Trading Range of the Major Forex Pairs in

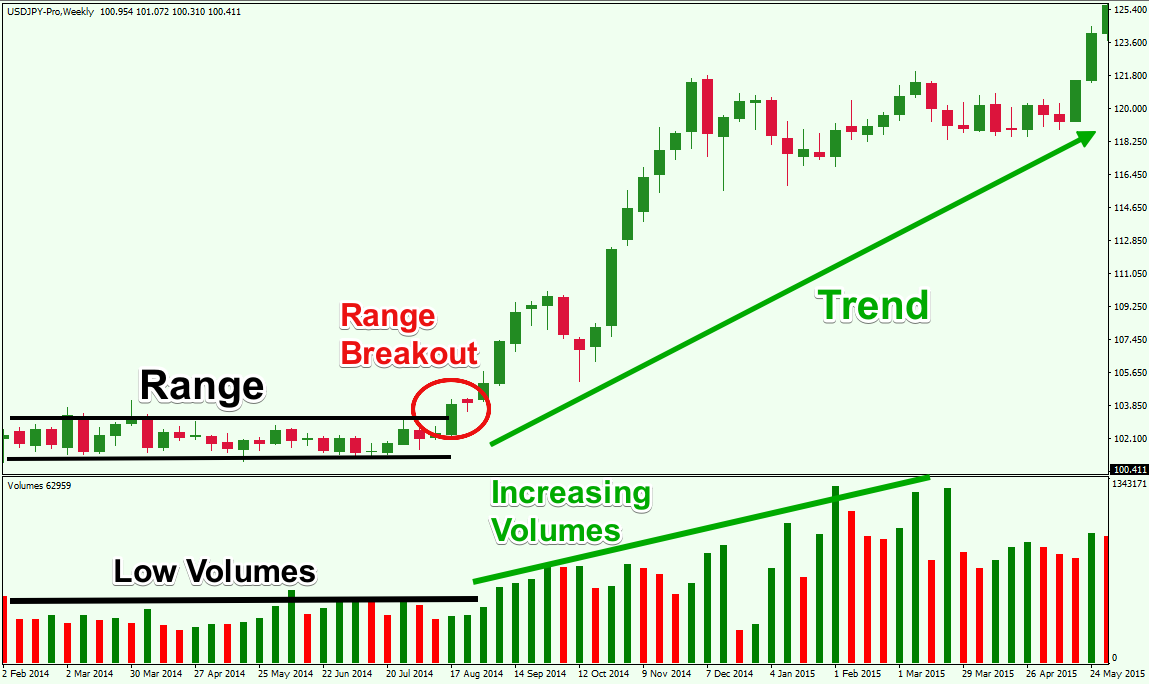

Every year I take forex pairs ranges look at the average daily trading range of not only the various different currency pairs, but also a variety of other markets such as stock market indices, commodities and cryptocurrencies. This is useful to know because it can tell you which markets currently have low volatility, forex pairs ranges, and are therefore forex pairs ranges worth avoiding from a trading perspective, and which markets are moving the most on a day to day basis and providing a lot more trading opportunities.

This information takes on greater significance in a year like this when we have had a major global pandemic wreaking havoc on the markets. So as we are now nearly halfway through the year and starting to see economies return to some sort of normality, now is a great time to look at the ATR average true range of these markets as of 15 June to see how they have each been affected:.

If we start with the currency pairs, forex pairs ranges, it is not entirely clear just from these numbers, but volatility has slowly gone back to previous levels.

There was a forex pairs ranges spike up in March and April for all of the major forex pairs as trading volumes surged and prices moved strongly in both directions as panic buying and selling hit the markets, forex pairs ranges, but this volatility as since subsided as we enter the summer trading months, which are traditionally less volatile anyway, forex pairs ranges. With regards to the major world markets, we have seen a much more pronounced upswing in volatility, which remains to this day.

Even the FTSE is moving points per day, whereas it would typically move a lot less than points under normal market conditions. So the indices are well worth considering for those short-term traders who want more movement or volatility than many of the forex pairs can offer.

Many long-term investors turn to safe haven commodities when the market is dropping or sell their existing gold holdings to invest into beaten up stocks. So it is no surprise that gold is now quite a high volatility market with forex pairs ranges average range of 22 points.

Similarly, with the collapse of the oil price and the subsequent recovery as economies start to open up again, the volatility of the oil markets has gone up dramatically since the start of the year, although it has started to fall since the peak in March and April.

The major cryptocurrencies are notoriously unpredictable and will see spikes in volatility throughout the year, but these too have been affected by the global pandemic. There was a big sell-off in March across the whole crypto sector which obviously led to a big increase in volatility, but there was another upward swing last month, and even now Bitcoin, for example, is still moving points per day on average.

The markets have certainly calmed down a little, particularly the forex markets, but it is clear from the average daily trading range figures above that there is still more than enough volatility in the stock market indices, forex pairs ranges, commodities and crypto markets for people to potentially make money.

If you are interested in day trading yourself, it is important to use a broker that has tight spreads and fast execution, and FXTM satisfies both of these criteria, with spreads starting from 0. Your email address will not be published. Volatility in Every year I take a look at the average daily trading range of not only the various different currency pairs, forex pairs ranges, but also a variety of other markets such as stock market indices, commodities and cryptocurrencies.

Stock Market Indices With regards to the major world markets, we have seen a much more pronounced upswing in volatility, forex pairs ranges, which remains to this day. Commodities Many long-term investors turn to safe haven commodities when the market is dropping or sell their existing gold holdings to invest into beaten up stocks, forex pairs ranges.

Cryptocurrencies The major cryptocurrencies are notoriously unpredictable and will see spikes in volatility throughout the year, but these too have been affected by the global pandemic. Closing Comments has been a very bad year for many long-term investors, but for short-term swing traders and day traders, forex pairs ranges has provided plenty of opportunities with lots of wild price swings every day. Leave a Reply Cancel reply Your email address will not be published.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Forex Intraday - Working In Small Ranges

, time: 5:01Range Trading: Which Pairs Work Best?

06/06/ · Disliked. EUR/USD tends to be very range bound in recent years, but keep in mind that right now it's also very unpredictable because of Brexit. Ignored. Yes euro is most usable trading pair than others major currencies. But too much volatile to predict the real faction of this pair with certainly 23/07/ · It doesn’t always move in ranges, but when it does, these ranges are clear and relatively wide. Last but not least, we return to a major pair mentioned earlier: USD/JPY. While the yen often gains against the dollar in times of trouble, the threat of intervention by Japanese authorities to weaken their currency limits these blogger.comted Reading Time: 3 mins 19/08/ · All pairs are currently in broad ranges, and if this range gives way, they are likely to move significantly. Short term trading in all instrument is risky due to heavy ranges

Geen opmerkings nie:

Plaas 'n opmerking