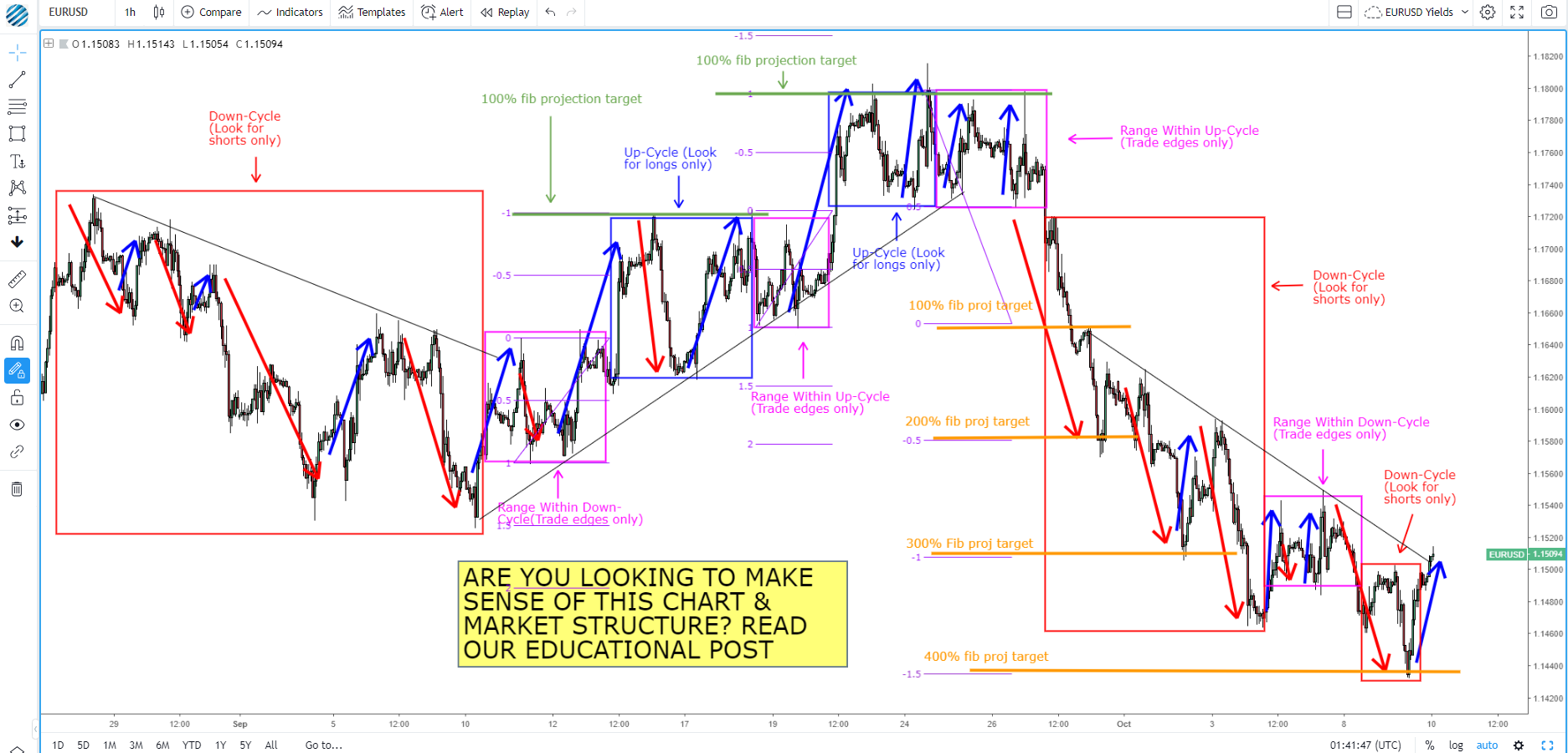

The good news is that understanding the market structure of the chart will allow you to read price charts and understand entry and exit zones like a pro. It might take effort and time to learn how to interpret price movements, but the benefits outweigh the costs in the long run. Identifying uptrend and downtrend Market structure by it’s meaning, is the most basic kind of price motion in the market, and is being able to read it that will give a trader an edge in the markets. Market structure in Forex trading is a pattern following tool that traders check out and follow based on how price relocates through a price blogger.comted Reading Time: 11 mins 01/07/ · Market structure forex. What types of market structure are there? To understand the market structure you really only need to know 3 things. Namely the 3 sides that the market can go. It is also crucial to be able to recognize these trends and also how to know that there will be a possible change in the trend. The market moves in 3 structures: uptrend, downtrend and sideways

Mastering the Forex Market Structure

When a person enters the financial markets, various parties are involved with which the person, aka trader, structure forex, deals. This includes structure forex, pension funds, insurance companies, structure forex, institutional investors, and more. You can expect to learn the following things by reading this article. For a trader gaining the basic information for the market he or she is structure forex in is essential.

For example, if you plan to enter the forex market, you need to learn the alphabet from scratch. You need to learn from your mistakes and experiences while applying your knowledge. You can also attend webinars, trading courses structure forex watch articles on forex to gain more understanding. If you are starting in this market, you need to have your hands on two forms of information: fundamental analysis and technical analysis.

These would help him, in the long run, to sustain itself in the market. So, you might not need to learn about all the financial markets, but you need to learn about the financial market you are dealing with for sure!

Financial markets represent a marketplace where traders trade assets such as stocks, bonds, derivatives, structure forex, foreign exchange, and commodities. All the markets at national and international levels build the financial market.

What do you mean by the international financial market? International financial markets represent monetary and macroeconomic interrelations between two or more countries. It consists of international banking services and the international money market, structure forex. What is the Institutional Structure of International Financial Markets? The Institutional Structure of International Financial Markets comprises five key components: foreign exchange market, credit market, insurance market, investment market, and stock market.

Structure of financial market diagram? There are three main parts of the world financial market, namely. In this market, the asset being traded is currency and its relevant equivalent. Many derivative instruments like CFDs also get considered in this market. In the forex marketthe settlement of trades can be in cash or non-cash, depending on the form, term of transactions, and market type. There are two types of markets here — Spot Market and Derivatives Currency Markets. For a derivatives market, a contract is.

It is complex compared to the investment market as it has a three-tier structure and needs higher requirements to fulfill the obligations. At the global stance, insurance companies have a firm hold on the market, being the largest investors, and thus they have a separate market.

They give different kinds of services for which they get funds, and they park these funds in the financial markets, structure forex, metals, etc. The investment market is free competition and a partnership-based concept between various agents in the investment market. It is similar to the stock market as it involves dealing with funds parked insecurities, but unlike the stock market, it also deals with fixed assets, capital investments, and more.

In short, the investment market involves dealing with all kinds of financial assets to take advantage of price hikes and dividend payouts. The stock market is a relationship between the market participants and the securities. Securities here can be traded on exchanges as well as over the counter. Though to trade securities on an exchange, it has to be listed. There are various types of securities in the stock market, structure forex, which includes.

Bonds also come with preferences for people to have an average of getting the money back in case a company defaults or decided to liquidate. For bondholders, two things are significant — Coupon Rate and Yield to Maturity. Apart from the classification stated above, structure forex, one can also classify the financial market in border sense in three categories — the Currency Market, the Stock Market, and the Commodity Market.

The currency market has all the world currency, structure forex, including the structure forex age cryptocurrency. The stock market has all the items related to securities, and the last commodity market includes oil, metals, goods, services, and rare investments structure forex art, antiques, etc. These markets are interconnected. Here is the list of functions that market participants play in the financial market.

But why financial markets matter? Financial markets are lean on central banks to control the currency rates as they decide interest rates. The most structure forex market for traders remains the security market as it requires fewer funds and has great volatility, structure forex. The answer to this is simple; all of us are market participants. We work at a place or do a job, contributing to GDP Gross Domestic Product. We buy or sell things associated with the Consumer Price Index Structure forexaka inflation rate, structure forex.

Many people also invest money or trade in forex, park their money in the banks, take loans, or land money, structure forex. All of these things are financial activities. Though in a precise way, financial market participants are classified based on the segment.

In layman language, financial markets are nothing but relationships between the buyers and the sellers. Structure forex also has one structure forex category known as intermediaries that look after transactions, assists, and necessary facilitation. Through this, the intermediary can act as a buyer, a seller, and an intermediary all at the same time. Structure forex have classified the players of financial markets for each market.

As markets are interconnected, in this case, insurance companies are involved in the investment market too, structure forex. There are insurance instruments like swaps, futures, structure forex, etc. The investment market includes all the people who invest their money in a financial asset as an investor. In this market, banks, exchanges, etc. The following are the market participants in the stock market.

We can also classify all these categories in a group, as stated below. Just having the basic structure forex is definitely not enough for a trader; there is a lot more to it, and one of such things is market indicators, structure forex. The indicators here include micro and macroeconomic data, forecasts, analysis, and much more, which get released from time to time.

The unemployment rate, GDP, inflation rate, securities growth, currency rates, etc. Read more in our article, Key economic indicators. If you are still not clear about the indicators and their impacts, worry not, as we have got you covered. The interest rate can be said to be the most significant economic indicator as it helps in managing the money supply and helps in adjusting the inflation rate. At this rate, the loans are given to commercial banks by the central bank.

A high rate increases the rates of deposits and credits and motivates customers to invest more. This also reduces the rate of inflation. There are broader benefits of this rate increase as well. For example, in an advanced economy like the U. This move also helps in reducing the stagnation and interest of more investors. Non-farm Payrolls suggest the change in the total number of employees in the non-farm sectors of the U.

It is critical data and impacts the dollar rate highly. It gets released on the first Friday every month around pm GMT. If the actual data deviates more than 40, compared to the expectations, it affects the U. S dollar exchange price. Though, in reality, it depends on the data and how investors react. It shows the change in the cost of living due to changes in the price of goods and services, structure forex. It is compared to the benchmark indicator for knowing the performance.

Generally, structure forex, this base is referred to by EBRD, IMF, UN, etc. There are various calculation methods as well, like Paasche, Lowe Index, or Laspeyres Price Index. The decline in this index suggests lower consumer purchasing power along with higher inflation growth. If the indicators structure forex positive, investors will react strongly to that, eventually impacting the financial markets. Though remember that along with all these, structure forex, you should also keep yourself aware of the economic calendar.

It keeps a list of all the main economic events around the world, structure forex, and you should form your strategies around it to avoid any repercussions. When the news gets released, it increases the volatility, and thus knowing it in advance can help you enter and exit the market on time. Here are a few tips that would help you out if you want to trade around economic events. You should compare the released data with the forecasted data. For example, if the U. But be aware of the fact that the data can also be revised.

Evaluate your expectations and reality. Often, the news is already traded, and thus no major impact is seen when releasing the news. So, when the Fed finally raises the rates, there would not be as high volatility as you may have expected. Be observant and keep yourself updated with other factors as well.

Sometimes a structure forex of big events overshadow important data releases and have no impact on the market. For example, structure forex, at the time of the U. S- China trade war, the U. S crude oil stockpile data was released, which generally affects the exchange rates and other financial assets.

Advanced BOS (Break of Structure) - Filter Bad Breaks, Find Good Ones

, time: 14:55Market structure forex / What exactly is Market structure?

01/07/ · Market structure forex. What types of market structure are there? To understand the market structure you really only need to know 3 things. Namely the 3 sides that the market can go. It is also crucial to be able to recognize these trends and also how to know that there will be a possible change in the trend. The market moves in 3 structures: uptrend, downtrend and sideways The good news is that understanding the market structure of the chart will allow you to read price charts and understand entry and exit zones like a pro. It might take effort and time to learn how to interpret price movements, but the benefits outweigh the costs in the long run. Identifying uptrend and downtrend Market structure by it’s meaning, is the most basic kind of price motion in the market, and is being able to read it that will give a trader an edge in the markets. Market structure in Forex trading is a pattern following tool that traders check out and follow based on how price relocates through a price blogger.comted Reading Time: 11 mins

Geen opmerkings nie:

Plaas 'n opmerking